Universal Credit Payment of the Limited Capability for Work and Work Related Activity Element

This briefing paper explains the Limited Capability for Work and Work Related Activity Element in Universal Credit and covers the relevant period, exemptions, backdating, and change of circumstances.

Read

Advice NI Briefing Paper - Universal Credit Payment of the Limited Capability for Work and Work Related Activity Element

Under the legacy regime, those claiming entitlement to benefits on the basis of limited capability for work were usually required to serve an assessment phase of 13 weeks (91 days) before any additional component in respect of their limited capability for work could be included in their Employment and Support Allowance (ESA) applicable amount. Legislation provided exceptions to this rule for those who were terminally ill or in certain specific cases where the claim linked to a previous claim on the basis of limited capability for work.

All of the same principles were retained in new-style ESA, including the provision to backdate entitlement to the support component where a determination that the claimant had limited capability for work-related activity took longer than 13 weeks.

This means that in both old-style and new-style ESA the support component would invariably be included in the claimant’s entitlement from the 92nd day of their entitlement to the benefit.

Owing in large part to the way in which entitlement to Universal Credit (UC) is assessed, we cannot give a blanket response to UC clients about when their claim might include a limited capability for work and work-related activity (LCWRA) element as this will depend on their initial claim and their reporting of limited capability for work.

The key difference is that the LCWRA element will not necessarily be included immediately after a ‘relevant period’ has been served, but only from the beginning of the next UC assessment period. As this relevant period will usually begin when the claimant declares limited capability to the Department, it is important that we advise clients to provide the necessary information at the outset of the claim to ensure that the Department can include the LCWRA element from the earliest possible date.

Relevant period – start date

The relevant period lasts for 3 calendar months. If the claimant has earnings above the ‘relevant threshold’ (equivalent to 16 hours per week at the National Minimum Wage) and they receive Attendance Allowance, Disability Living Allowance or Personal Independence Payment, then the relevant period will commence on either the first day of their award or the date that they apply for the LCWRA element.

However, in all other cases the relevant period commences ‘on the first day on which the claimant provides medical evidence of limited capability for work’.

The Medical Evidence Regulations stipulate that medical evidence of limited capability should be in the form of a statement of fitness for work signed by a doctor, unless it would be unreasonable to require this. Regulations also allow a claimant to provide a self-certificate for the first 7 days of a period of limited capability for work – for UC purposes, this must be a written statement made on an approved form. That would allow claimants to provide evidence on an earlier date, for example where they have difficulty obtaining a statement of fitness for work from their doctor.

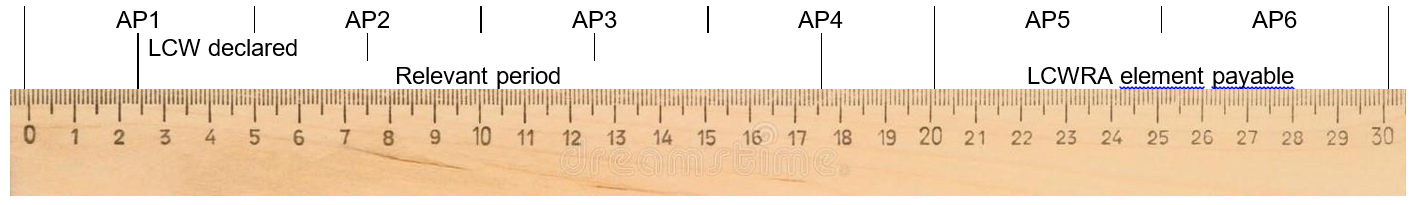

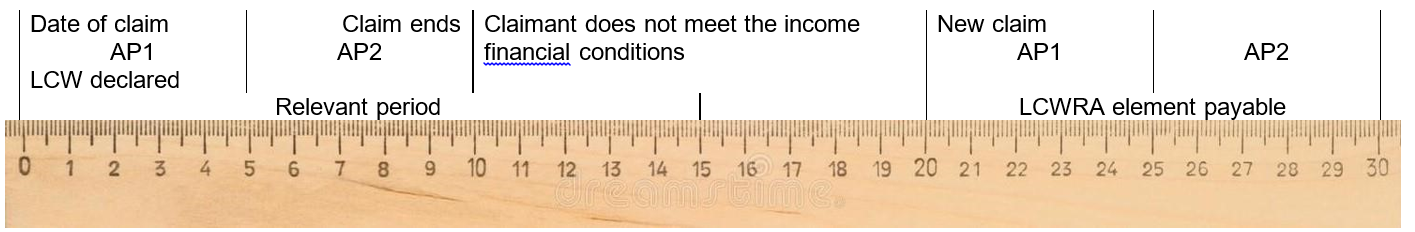

As an assessment period is 1 calendar month, this means that new claimants would need to provide medical evidence on the first day of their claim in order for the relevant period to align and the LCWRA element to be included in their fourth assessment period (see Figure 1). If they do not, then the LCWRA element will not be included until their fifth assessment period, at the earliest (see Figure 2).

However, the Department have confirmed that in general they will take the beginning of the relevant period from the date that the claimant declares limited capability for work, whether in writing or verbally, rather than the date that formal written evidence is supplied. If cases arise where the Department has not applied this principle, advisers and claimants are encouraged to contact UC to see if an earlier date can be accepted. In principle, a formal dispute could be raised, but it should be noted that this approach arises from the Department’s interpretation of the legislation rather than the legislation itself.

Adviser Checks

- When did the client make their claim to UC?

- When did the client declare limited capability for work?

- What sort of declaration did the client make?

- What date did the Department record as the date of declaration?

- When did the client provide medical evidence?

- What is the client’s assessment period?

Relevant period – exceptions

There are a limited set of exceptions to the relevant period, which reflect to some extent the equivalent rules for Employment and Support Allowance. Taken in the order in which they appear in the regulations, they are as follows:

|

Exception |

Date LCWRA element included |

|---|---|

|

Claimant previously entitled to UC including the LCWRA element |

First day of entitlement |

|

Claimant previously entitled to UC but the relevant period did not end |

First day of assessment period following the date the relevant period would have ended on previous claim |

|

Claimant is terminally ill |

First day of entitlement or first day of assessment period in which application for LCWRA element made |

|

Claimant entitled to ESA including the support component |

First day of entitlement |

It is important to note that the first two exceptions only apply where the award was terminated because the claimant ceased to be or became a member of a couple immediately before the present claim, or where the award was terminated in the previous 6 months because the claimant(s) no longer met the income financial conditions

Adviser Checks

- Is the client terminally ill?

- Has the client recently been in receipt of either UC or ESA?

- Did the prior claim include a determination on limited capability for work?

Backdating

Whereas the assessment phase of ESA is a period of 13 weeks that can be extended if the work capability assessment is not completed in that time-frame, the relevant period in UC is a fixed period of 3 months. As such, there is no need for a provision to backdate entitlement to the LCWRA element as it will always be included from the beginning of the assessment period following that in which the relevant period ends.

As a result, in the rare cases where a delay to the work capability assessment prevents the LCWRA element being included from the appropriate assessment period, then arrears of benefit should be due to the claimant. The only exceptions to this would be where there is a question arising from a claimant’s failure to comply with specific aspects of the work capability assessment – in such cases, the claimant or the adviser should approach the Department to establish whether good reason can be accepted.

In general, the date for claiming UC is the first day of the period for which the claim is made. However, provision is made for extending the time limit by up to 1 month in specific circumstances:

- Department failed to notify the claimant that a prior claim to ESA or Jobseeker’s Allowance was due to expire;

- claimant has a disability;

- claimant has medical evidence that an illness prevented them from claiming;

- official computer system was inoperative;

- claimant’s partner refuses a claimant commitment and claimant separates from partner to make a claim as a single person.

Whether the provision to backdate entitlement to UC will affect the claimant’s assessment period is left for the Department to determine based on their administration of the claim. As such, we will need to wait for the outcome of any decision on backdating before we will be in a position to advise clients about the date from which the LCWRA element might be included in their award.

Adviser Checks

- Does the client’s UC claim include a period prior to the date of claim?

- Was the client’s assessment period affected as a result?

Changes of circumstances

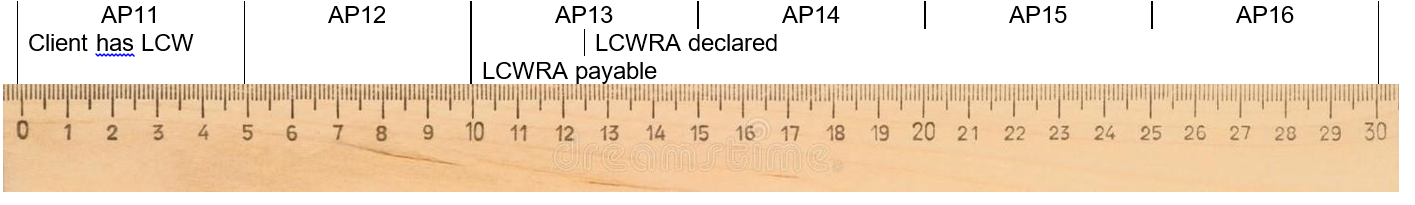

Existing Universal Credit claimants that do not yet have a determination as to whether they have limited capability for work will be subject to the relevant period in the same way as new claimants, unless one of the exceptions applies (see Figure 4). As such, this is the group most likely to find themselves waiting longer for the LCWRA element to be included in their award as their claim will be less likely to align with their period of limited capability for work.

The Advice for Decision Making Guide outlines an exception to the relevant period in cases where the UC claimant has already been determined to have limited capability for work but later in the claim reports a change of circumstances that leads to a further determination that they have limited capability for work and work-related activity. The example given suggests that in these cases the claimant will be entitled to the LCWRA element from the beginning of the assessment period in which they report the change in their condition.

This is broadly in line with the rules on supersession. A decision that a claimant is entitled to a LCWRA element as part of their UC award would be one that is advantageous to the claimant. As such, providing the claimant reports the change within the time limit (this is usually within the assessment period in which the change occurred, then the change to the benefit would apply from the beginning of that assessment period. However, if the claimant does not report a change within the time limit then the change will only apply from the beginning of the assessment period in which the change was reported.

Reassessment can also be instigated by the Department. In cases where the result is that the claimant is subsequently awarded a LCWRA element it will be included from the beginning of the assessment period in which the medical examination takes place, which the Department interprets as the earliest date at which potential entitlement to the LCWRA element came to their attention.

Adviser Checks

- Does the client already have a claim for UC?

- Does the client’s UC claim include a determination on limited capability?

- When did the client inform the Department about their limited capability?

- Has there been a change in the claimant’s condition that warrants reassessment?

Appendix

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Contact information

Advice NI Policy Team

Advice NI

Forestview

Purdys Lane

Belfast

BT8 7AR

Tel: 028 9064 5919