Budgeting

The simplest way to understand your finances is to work out your budget.

Creating a Budget

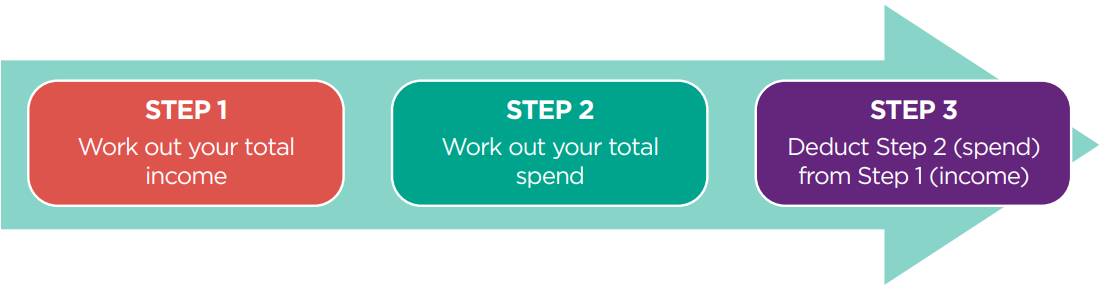

Budgeting Steps

| Step 1 | To work out your income list all of the money you have coming in on a monthly basis and add it together. Income might be from salary, benefits, pensions, child maintenance, and so on. |

| Step 2 | To work out your total expenses (spend) list all of the money you have going out on a monthly basis and add it together. A budget planner (see page 4) can help you to identify outgoings. Include all costs, even those which are infrequent. Look at bank statements and use a Spending Diary (see page 5) to help you to identify spending habits and amounts. Typical expenses include groceries, utilities (e.g. gas, electricity), housing (e.g. rent, rates, mortgage, insurance), children (e.g. childcare, school dinners), education, phone, insurance, leisure, transport, pets, health, subscriptions, and clothing. |

| Step 3 | To work out your budget take away your expenses from your income. |

Example

Siobhan’s Budget:

STEP 1: Income = £1,325/Month

STEP 2: Expenses = £1,225/Month

STEP 3: Income (£1,325) minus Expenses (£1,225) = £100.

Important

When working out a budget always make sure amounts are worked out in the same frequency of payments e.g. weekly, monthly or quarterly.

To convert weekly payments to monthly payments: multiple the weekly amount by 52 and divide by 12.

To convert monthly payments to weekly payment: multiple the monthly amount by 12 and divide by 52.

To convert quarterly payment to monthly payments: multiple the quarterly by 4 and divide by 12.

Budgeting Tools

Below are some budgeting tools that might help.

|

Resource |

Access |

|

Advice NI Budget Planner |

|

|

Advice NI Spending Diary |

|

|

Money Helper Online Budget Planner |

|

|

Demotivator - Online Non-Essential Spending Calculator |

What Does Your Budget Mean?

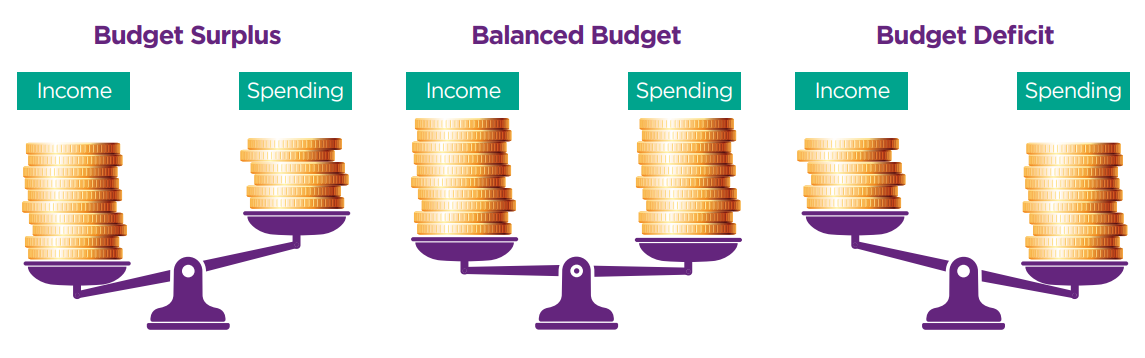

When you calculate your budget (Steps 1-3) your answer will reveal one of three outcomes:

If your budget is in surplus (more money coming in than going out) it is healthy. If your budget is balanced (same amount in as out) or in deficit (more going out than coming in) it is unhealthy.

Learning from Your Budget

Your budget can help you to manage your finances, make healthy financial choices, help you plan for the future, help you to meet financial goals or tackle financial difficulties.

Healthy Budget

If your budget is healthy you can decide whether you are able to put some of the surplus aside to ensure you have savings for the unexpected (e.g. a change of circumstances).

Unhealthy Budget

If your budget is unhealthy consider the following:

- Are there any opportunities to increase your income (e.g. unclaimed benefits, increased work hours, and so on)?

- Are there any expenses on the list that could be reduced or cut out (e.g. non-essential)?

To improve your budget have a look at our ‘Making the Most of Your Money’ guide (see page 6). If you have a deficit budget, it is advisable to seek immediate FREE Independent Advice and speak to an Adviser who can help you.

Free local advice

Community Advice Craigavon

- Email enquiry@advicecraigavon.com

- Call 028 3836 1181

Community Advice Armagh